What is a voucher?

A written record that serves as proof of any commercial transaction is called a voucher. It is a source document that serves as proof when entries are made in the Journal or other subsidiary books, which are the main business books.

How are vouchers created?

Voucher preparation requires various supporting documents such as:

- The invoice received by the supplier from the company

- Supplier contact details such as name, address, and contact number

- Payment details such as amount, discount, or payment due date

- Details relating to the original order the business placed with the supplier

- Receipt with transaction details confirming receipt by the business receipt of goods or services as shown on the invoice

- Details of general ledger accounts related to the specific transaction

- Signature of the company’s authorized signatory confirming the purchase of goods or services as well as the receipt receiving payment

- Proof of payment

The main steps involved in issuing vouchers are as follows:

- The company contacts the supplier to order materials or sell the finished product. If the supplier agrees to the specifications and order quantity, the company places an order with them.

- The supplier prepares and sends orders to the company.

- Quality checks are performed to see any defective or damaged items in this shipment.

- The person(s) responsible for quality control also checks that orders conform to specifications.

- Once the company is satisfied with the order, it creates a document for the transaction with relevant details and supporting documentation.

- Vouchers and documents are then thoroughly checked by both parties to ensure there are no errors. Post this, the company pays the supplier for the mailing.

Types of vouchers

There are two major types of vouchers;

- Cash Voucher: A company prepares these vouchers specifically for cash transactions, such as payments and receipts. A company may produce a Debit Voucher solely for cash payments to suppliers or vendors to buy semi-finished goods and raw materials for production, acquire assets, or cover expenses. Another option is a credit voucher, which a business generates just for cash receipts from clients or suppliers when selling products to clients, selling assets, or receiving revenue.

- Non-Cash Vouchers: Also referred to as transfer vouchers, these vouchers are made exclusively for credit transactions. These transactions include, for instance, the purchase or sale of products on credit, the acquisition or sale of fixed assets on credit, etc.

The following categories for the vouchers might also be used based on how complicated a transaction is:

- Transaction Voucher: This is a document that the company creates when a transaction debits one account and credits another.

- Compound Voucher: This is a voucher that the business prepares for two different kinds of transactions. The first kind involves multiple accounts being credited for a transaction, but just one account being debited. The second kind involves multiple accounts being credited for a transaction, but just one account being debited.

- Complex Voucher: A complex voucher is one that a business creates when a transaction involves the debiting and crediting of several accounts.

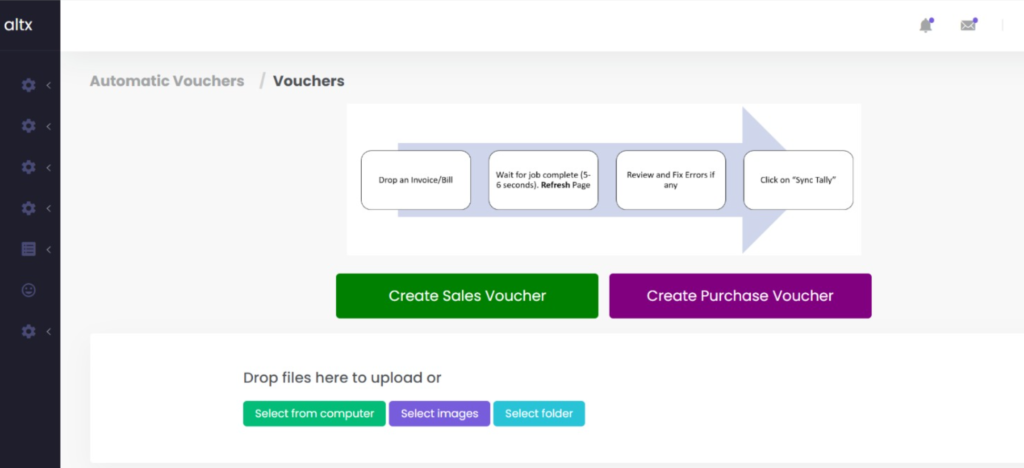

What is Automated voucher creation?

Automated voucher creation is a process in which technology and software tools are used to streamline and expedite the creation of vouchers for various financial transactions within a business. Automation may significantly improve overall efficiency in accounting and financial reporting processes by reducing the need for human labor and improving accuracy. A few essential components of automatically generating vouchers are as follows:

- Data Capture: Automated voucher-generating systems may capture and store transaction data from a variety of sources, including purchase orders, invoices, receipts, and other relevant documents. Since this data is extracted automatically and electronically, there is usually less need for human data entry.

- Workflow Automation: These systems usually include workflow automation features that let transactions go through set approval processes. Delays in creating vouchers can be reduced by sending transactions to the appropriate staff members for approval.

- Integration: Automated voucher generation software is often integrated with other accounting and financial systems, such as enterprise resource planning (ERP) software. This link ensures the accuracy and consistency of financial data across all platforms.

- Data Validation: The software may run data validation checks to ensure that the data entered into the vouchers is accurate and compliant with the organization’s policies and procedures. This helps to prevent errors and inconsistencies.

- Audit Trails: Systems that generate vouchers automatically record each transaction in detail, starting at the time of creation and ending at the point of approval. Meeting audit and compliance criteria is facilitated by this

Voucher creation: issues and bottlenecks

Some common issues and bottlenecks seen with voucher creation are :

- Missing or Incomplete Information :

The difficulty is that when voucher creators come upon information that is either missing or insufficient, it can constitute a significant danger to the reliability of financial records and the correctness of those data. It is common practise to find that the information that is investigated is lacking essential particulars regarding essential aspects of the transaction, such as dates, descriptions, quantities, or parties involved in the transaction.

- Manual Errors:

In some cases, the production of vouchers is hampered by the problem of human error, specifically in the processes of data entry, computation, and transcription. These mistakes may have been brought about by typographical errors, inaccurate calculations, or a misunderstanding of the documentation that was provided in support of the claim.

- The absence of adequate internal controls:

The problem here is that inadequate internal controls can lead to fraudulent or unauthorised transactions being recorded in vouchers, and this is the source of the problem. If there is not sufficient control and authorization in place, there is a greater possibility that improper financial activity will go undiscovered. This is because of the increased likelihood that it will be possible for the behaviour to be concealed.

- Communicating with one another and coordinating efforts:

Proper communication and coordination among the numerous departments and individuals who are engaged in the process of issuing vouchers is vital to ensure that financial records are correct and complete. This is because improper communication and coordination can lead to inaccurate and incomplete records. If there is a breakdown in communication or a lack of cooperation among those involved in the process, it is probable that there will be misunderstandings and mistakes made.

altx and how it helps with vouchers

altx empowers SMEs with robust cash flow management. Its dashboard offers key metrics and debt identification. Collaboration via several channels, including email, WhatsApp, and SMS. Enhanced client connections can be achieved through the use of pre-recorded IVR messages, automatic follow-ups, daily cashflow reports, ledgers, and data insights.

1. Data Entry Errors:

altx automates data entry, eliminating errors and maintaining voucher accuracy. Automation reduces human data entry errors. altx automates data entry, improving accuracy and reducing error correction time.

2. Missing Documents Solution:

altx attaches and links important documents to vouchers for quick retrieval. This attachment function streamlines documentation and ensures all documents are available. altx’s document management speeds up the process, lowering the danger of losing important information.

3. Multiple Data Sources:

altx centralizes data from several sources to simplify voucher production. Integrating data from multiple sources into a single platform simplifies the process. altx simplifies data management for voucher creation by integrating data from several sources.

4. Audit Trail Challenges:

altx simplifies audits and compliance by creating detailed voucher audit trails. These audit trails show all voucher changes and actions. altx’s automated audit trail records all voucher actions, making auditing and compliance checks easier and more transparent.